본문

In today's globe, where uncertainties loom big and unexpected conditions can turn our lives inverted, it is essential to have a security web to shield our loved ones from economic difficulties. This is where term life insurance coverage enters into play, providing people and families a satisfaction by guaranteeing their economic security for a specified period.

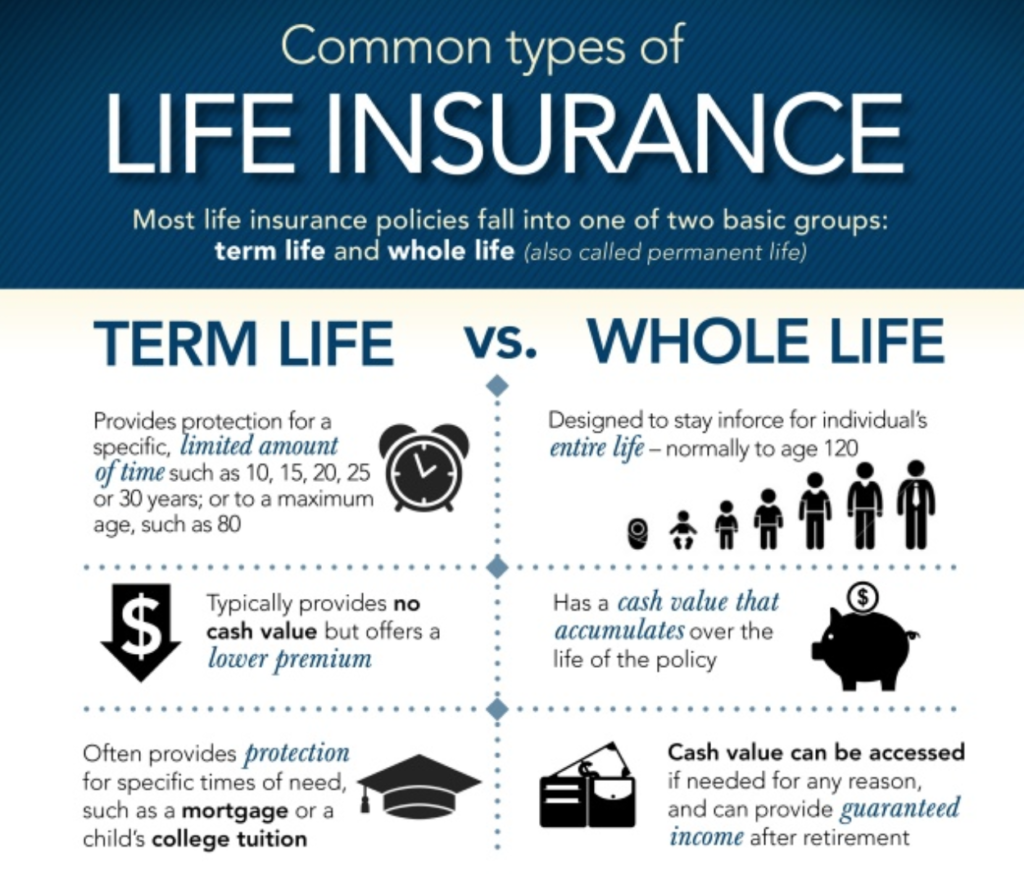

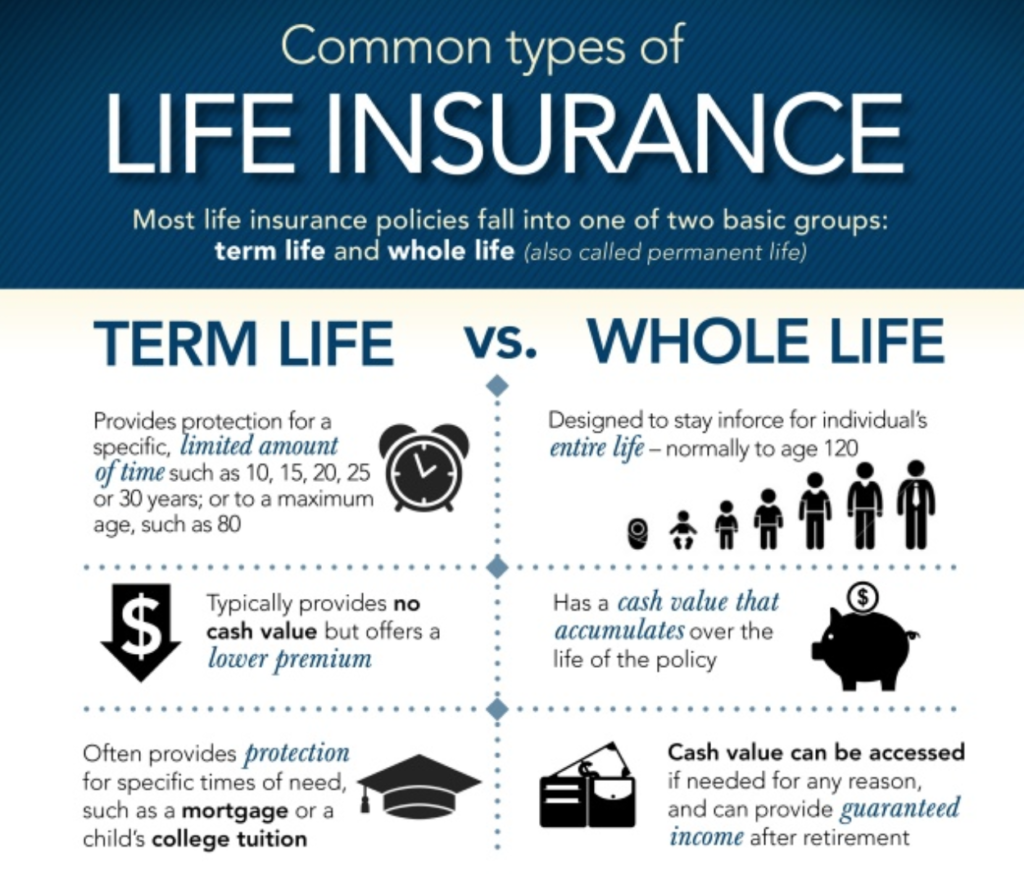

Term life insurance policy is a sort of life insurance coverage policy that provides insurance coverage for a set term or a certain variety of years. Unlike long-term life insurance, which offers coverage for a life time, term life insurance policy is more economical and optimal for people seeking temporary security during important durations of their lives. This coverage is particularly useful for young moms and dads, property owners with home mortgages, and individuals burdened with debts.

Term life insurance policy is a sort of life insurance coverage policy that provides insurance coverage for a set term or a certain variety of years. Unlike long-term life insurance, which offers coverage for a life time, term life insurance policy is more economical and optimal for people seeking temporary security during important durations of their lives. This coverage is particularly useful for young moms and dads, property owners with home mortgages, and individuals burdened with debts.

One of the significant benefits of term life insurance policy is its cost. As this kind of insurance coverage just covers a details duration, premiums are typically reduced contrasted to permanent Life insurance for young adults insurance policies. This affordability makes term life insurance coverage an easily accessible choice for individuals and households with tight budgets and countless economic responsibilities.

Term life insurance policy allows insurance policy holders to figure out the length of protection that fits their needs. Depending upon their conditions and economic responsibilities, individuals can tailor their plans, ranging from 10 to thirty years. This flexibility makes sure that insurance holders are not spending for protection that extends past their demands or after their dependents have ended up being economically independent.

Term life insurance policy gives financial protection during vital phases of life. Term life insurance policy likewise serves as a safety web for people with outstanding financial debts, such as pupil car loans or individual loans, ensuring that their loved ones are not left liable for these monetary responsibilities.

While term life insurance policy offers many advantages, it is necessary to comprehend that this insurance coverage has its limitations. Unlike long-term life insurance policy plans, term life insurance policy does not accumulate money value that can be obtained against or withdrawn. Furthermore, once the policy term ends, beneficiaries are no more covered unless the insurance holder restores the policy or acquisitions a new one.

Picking the appropriate term life insurance coverage policy can be an overwhelming task. It is important to take into consideration several factors, such as the plan's coverage amount, premiums, and length. Consulting a knowledgeable insurance representative can provide important advice and make sure that individuals and families choose the most ideal plan for their details requirements.

To conclude, term life insurance policy provides people and family members an important layer of monetary defense during unforeseeable times. With its cost, adaptability, and targeted insurance coverage, this sort of insurance coverage provides peace of mind, permitting insurance holders to deal with the future with self-confidence. By protecting term life insurance policy, individuals can safeguard their enjoyed ones from potential financial difficulties and supply them with the monetary Income protection insurance they are worthy of.

Term life insurance policy is a type of life insurance policy that gives protection for a fixed term or a certain number of years. Unlike long-term Life insurance for seniors insurance, which supplies coverage for a lifetime, term life insurance is much more affordable and ideal for people looking for short-lived protection during essential durations of their lives. Term life insurance supplies economic protection during important phases of life. Unlike permanent life insurance plans, term life insurance does not collect cash value that can be obtained versus or withdrawn.

If you adored this post and you would such as to obtain more information pertaining to Life insurance for young adults kindly check out our site.

Term life insurance policy is a sort of life insurance coverage policy that provides insurance coverage for a set term or a certain variety of years. Unlike long-term life insurance, which offers coverage for a life time, term life insurance policy is more economical and optimal for people seeking temporary security during important durations of their lives. This coverage is particularly useful for young moms and dads, property owners with home mortgages, and individuals burdened with debts.

Term life insurance policy is a sort of life insurance coverage policy that provides insurance coverage for a set term or a certain variety of years. Unlike long-term life insurance, which offers coverage for a life time, term life insurance policy is more economical and optimal for people seeking temporary security during important durations of their lives. This coverage is particularly useful for young moms and dads, property owners with home mortgages, and individuals burdened with debts.One of the significant benefits of term life insurance policy is its cost. As this kind of insurance coverage just covers a details duration, premiums are typically reduced contrasted to permanent Life insurance for young adults insurance policies. This affordability makes term life insurance coverage an easily accessible choice for individuals and households with tight budgets and countless economic responsibilities.

Term life insurance policy allows insurance policy holders to figure out the length of protection that fits their needs. Depending upon their conditions and economic responsibilities, individuals can tailor their plans, ranging from 10 to thirty years. This flexibility makes sure that insurance holders are not spending for protection that extends past their demands or after their dependents have ended up being economically independent.

Term life insurance policy gives financial protection during vital phases of life. Term life insurance policy likewise serves as a safety web for people with outstanding financial debts, such as pupil car loans or individual loans, ensuring that their loved ones are not left liable for these monetary responsibilities.

While term life insurance policy offers many advantages, it is necessary to comprehend that this insurance coverage has its limitations. Unlike long-term life insurance policy plans, term life insurance policy does not accumulate money value that can be obtained against or withdrawn. Furthermore, once the policy term ends, beneficiaries are no more covered unless the insurance holder restores the policy or acquisitions a new one.

Picking the appropriate term life insurance coverage policy can be an overwhelming task. It is important to take into consideration several factors, such as the plan's coverage amount, premiums, and length. Consulting a knowledgeable insurance representative can provide important advice and make sure that individuals and families choose the most ideal plan for their details requirements.

To conclude, term life insurance policy provides people and family members an important layer of monetary defense during unforeseeable times. With its cost, adaptability, and targeted insurance coverage, this sort of insurance coverage provides peace of mind, permitting insurance holders to deal with the future with self-confidence. By protecting term life insurance policy, individuals can safeguard their enjoyed ones from potential financial difficulties and supply them with the monetary Income protection insurance they are worthy of.

Term life insurance policy is a type of life insurance policy that gives protection for a fixed term or a certain number of years. Unlike long-term Life insurance for seniors insurance, which supplies coverage for a lifetime, term life insurance is much more affordable and ideal for people looking for short-lived protection during essential durations of their lives. Term life insurance supplies economic protection during important phases of life. Unlike permanent life insurance plans, term life insurance does not collect cash value that can be obtained versus or withdrawn.

If you adored this post and you would such as to obtain more information pertaining to Life insurance for young adults kindly check out our site.

댓글목록

등록된 댓글이 없습니다.